July Highlights

- Mortgage rates and limited inventory continue to be the driving factors behind today’s real estate market data – specifically sticking out when looking at home sales and new listings which are both down across all counties and categories in South Florida.

- In fact, the number of homes listed in the first half of 2023 is the lowest in recorded history, keeping inventory extremely tight.

- July’s mortgage rates varied around 7%, but as we head towards the Fall months, mortgage rates are expected to continue their trend upwards, most likely hitting 8% around September.

- With affordability already a concern for consumers, serious buyers need to be ready to strike in this market with updated preapprovals and knowledge of helpful mortgage options such as buydowns or assumptions.

- The number of homes listed remains so low because of would-be sellers who are delaying listing their homes to maintain their covid-era mortgage rate. Inventory is trying it’s best to recover, but the demand in the market is keeping progress slow.

- Note, buyer demand is sufficient in the market already, but in South Florida there is an even higher demand for homes in the area. Cash buyers, overseas buyers/investors, snowbirds, retirees, etc. are all cohorts that put an additional strain on South Florida inventory levels.

- Usually, high demand and low inventory would lead to an increase in prices. But economic factors such as increased mortgages rates and inflation are straining overall consumer affordability which will keep housing prices from sky rocketing.

- Inevitably, sellers will need to put their homes on the market due to life changes such as downsizing, growing families, career changes, divorce, etc. which will help to bolster inventory levels. Sellers, there are several steps you can take to create sufficient demand on your home so you can attract the most buyers!

SOUTH FLORIDA

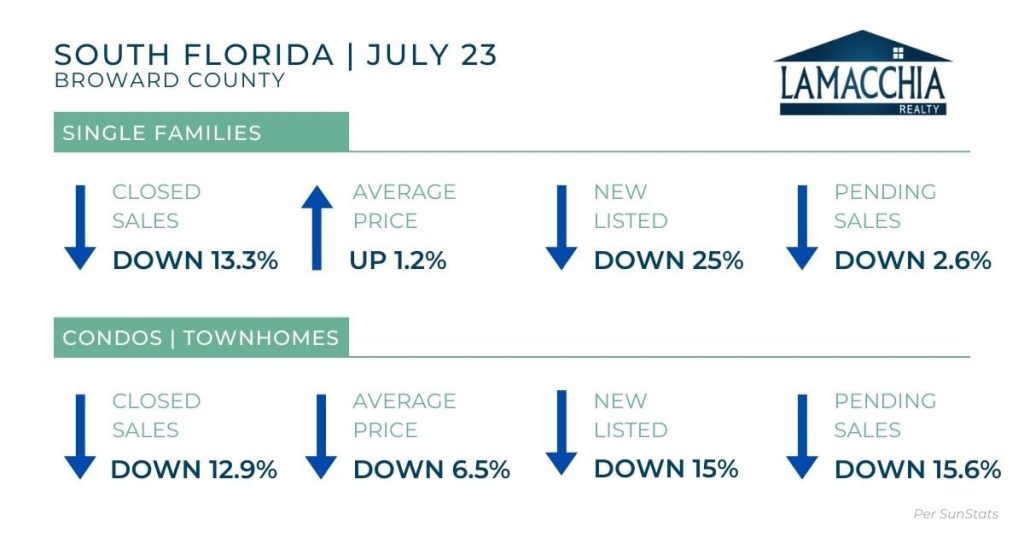

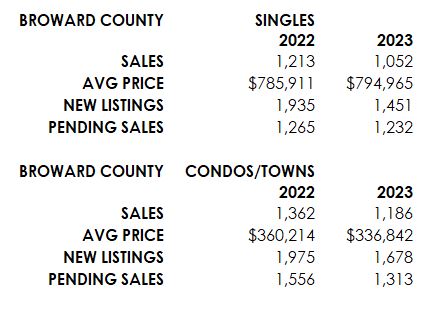

Broward County

In July of 2023, Broward County single-family homes and condos/townhomes saw decreases in most categories, except the average price for single families rose 1.2% compared to July 2022.

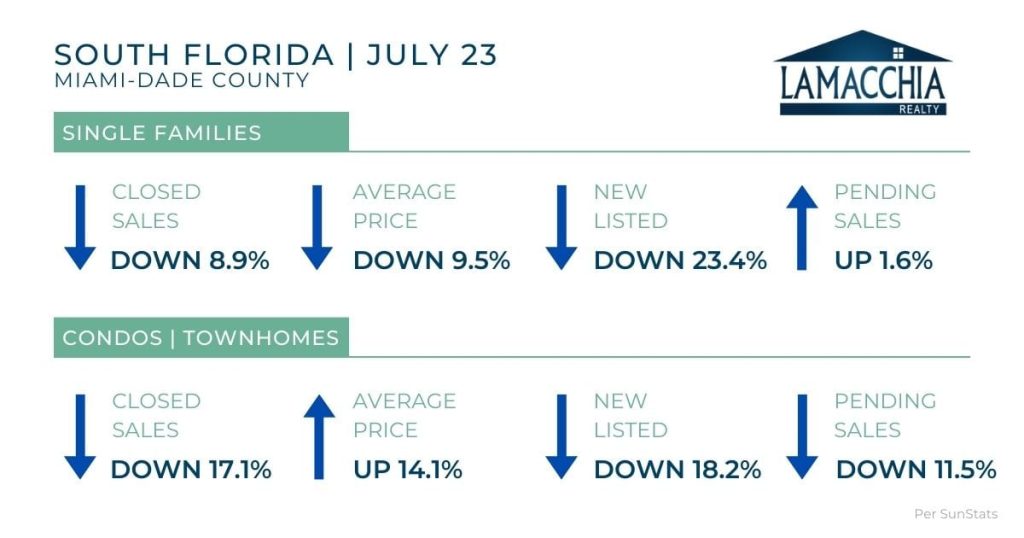

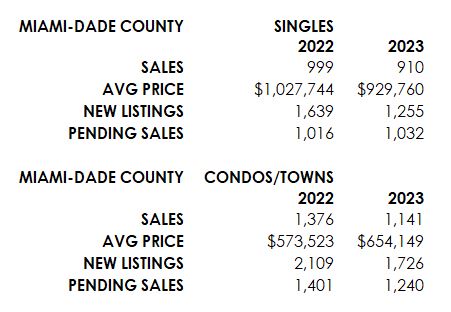

Miami-Dade County

In July of 2023, Miami-Dade single-family homes and condos/townhomes saw decreases in closed sales and new listings. Average price was down for single families, but up for condos/townhomes. Additionally, pending sales were up for single family homes and down for condos/townhomes.

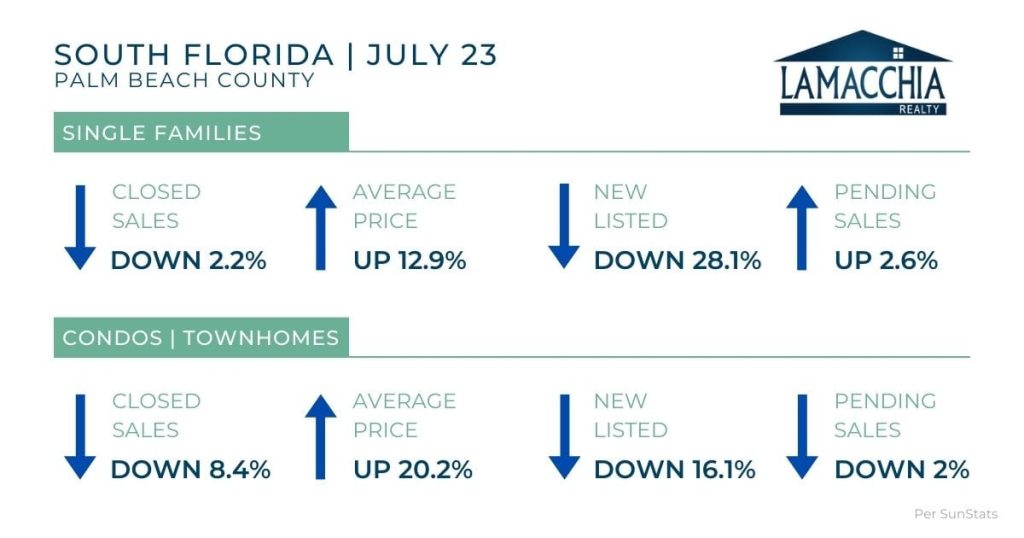

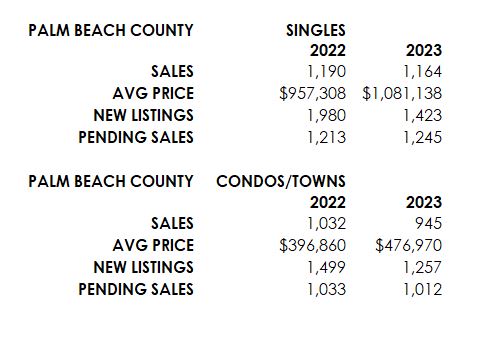

Palm Beach County

In July of 2023, Palm Beach single-family homes and condos/townhomes saw decreases in closed sales and new listings. Average price was up for single families and condos/townhomes. Pending sales were up for single family homes and down for condos/townhomes.

Data provided by SunStats then compared to the prior year.