NEW HAMPSHIRE

Home Sales Down, Average Prices Up

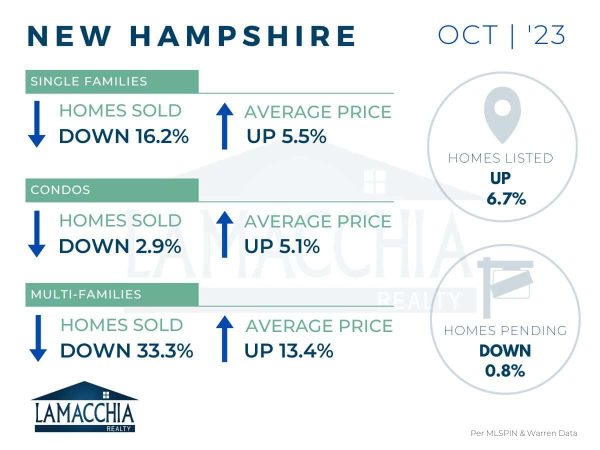

Home sales are down 14.5% year over year, with October 2023 at 1,533 compared to 1,792 last October. Sales are down across all categories.

- Single families: 1,300 (2022) | 1,089 (2023)

- Condominiums: 381 (2022) | 370 (2023)

- Multi-families: 111 (2022) | 74 (2023)

Average sales price increased by 5.2% when compared to last October, now at $538,691. Prices for single families, condos, and multi-families increased.

- Single families: $546,629 (2022) | $576,610 (2023)

- Condominiums: $412,457 (2022) | $433,378 (2023)

- Multi-families: $447,422 (2022) | $507,235 (2023)

Homes Listed For Sale:

The number of homes listed is up by 6.7% when compared to October 2022.

- 2023: 1,858

- 2022: 1,741

- 2021: 1,920

Pending Home Sales:

The number of homes placed under contract is down by 0.8% when compared to October 2022.

- 2023: 1,673

- 2022: 1,686

- 2021: 2,283

Data provided by NEREN then compared to the prior year.

What’s Happening in the Market?

Mortgage rates officially went over 8% in the month of October according to Mortgage News Daily. In New Hampshire, the number of homes sold is down 14.5% when compared to October 2022. The average sales price has increased 5.2%. The number of homes listed was up 6.7% compared to this time last year which is a good indicator of market activity as things aren’t decreasing.

What does this mean for Buyers?

- October proved to be a challenging month for buyers, with mortgage rates reaching levels not seen for more than 20 years, and inventory levels still unable to support demand. However, inventory levels are increasing, recently surpassing 2021 levels.

- With these factors in mind, affordability and availability of homes remain chief concerns amongst active buyers, especially with home prices still elevated when compared to previous years. Important to note that although home prices are rising, they aren’t rising nearly as much given market conditions. This decrease in overall consumer affordability is what’s keeping housing prices from soaring out of control.

- Make sure you are staying prepared and informed! Mortgage options such as buydowns or assumptions could be great options for buyers in this market.

- In challenging markets like this one, working with an experienced buyer’s agent will prove helpful to make sure you are getting the most out of the home buying experience!

What does this mean for Sellers?

- Homes listed in New Hampshire are up which could indicate that want-to-be sellers who have been on the sidelines due to mortgage rate and inventory concerns are getting back in the game. Despite their concerns about the market, sellers may have needed to list due to changing life circumstances such as relocating for work, divorce, growing families, downsizing, etc. – sometimes change is inevitable! In this current economic environment with inflation, ongoing international conflicts, etc., it is difficult to predict what the future may hold, so the best time to get your real estate goals accomplished is when the timing is right for YOU!

- If you are planning on listing your home, know that pricing is crucial in this market to ensure that you are creating the most demand for your home which ultimately gives you more negotiating power.

- Since many sellers are also buyers, pricing competitively will allow you to set favorable terms which is critical for those in sell/buy situations.

What’s next?

Typically, market activity starts to cool as we head towards the end of the year due to the holiday season, winter weather, etc. However, homes DO sell during the holidays! Buyers who continue looking during the holiday season are far more serious and motivated than at other times of the year when there is an increase in casual lookers. For sellers, this means you are more likely to receive quality offers on your home, and for buyers, it means less competition! Don’t miss the opportunity that lies ahead in these next couple of months, especially if you are looking to buy or sell before the end of the year!